Learn about the perks of homeownership over renting an apartment.

Learn how credit is determined, how to improve credit, and how it effects the rate of your home loan.

Learn about why preparation is beneficial before jumping into homeownership.

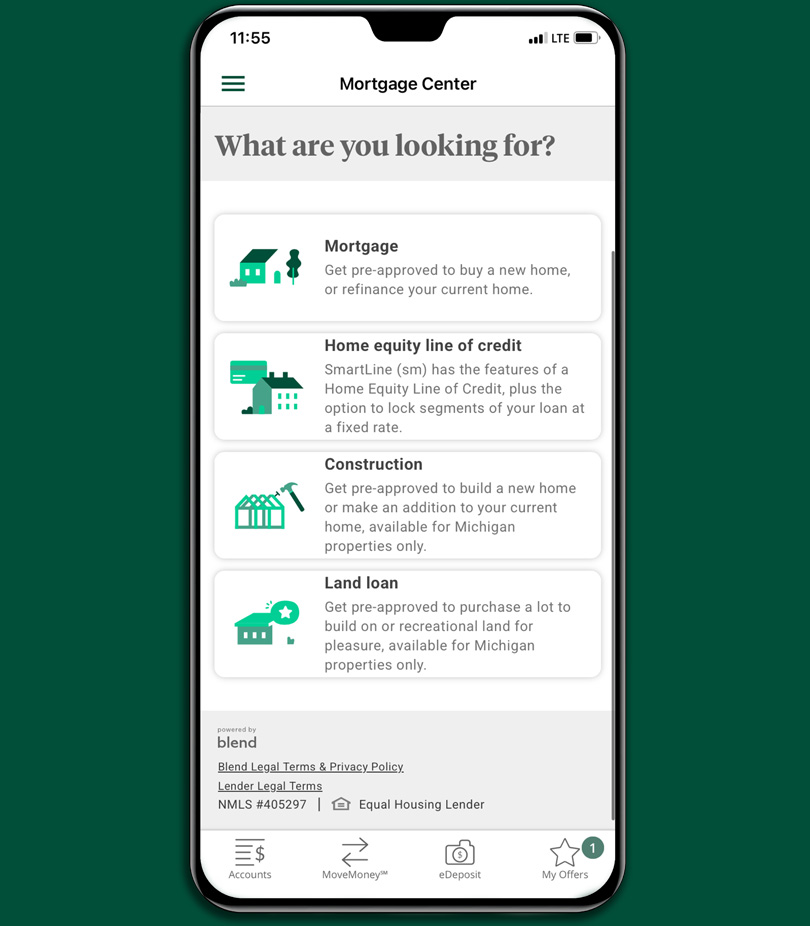

Browse through the different loan types we offer and determine which loan is best for you.

Make sure everything you need is in order for a smooth process.

Make sure everything you need is in order for a smooth process.

MSUFCU now offers the Affiliated Affinity Real Estate Benefits Program, providing a cost-free, value-packed experience for members nationwide. Whether you're buying or selling a home and don’t have an established realtor, this service is designed to help.

Looking to make a renovation, start a home improvement project, or pay off other high-interest debt? A SmartLineSM Home Equity Line of Credit (HELOC) loan allows you to put your home’s equity to work for you.

Save money by refinancing your home loan at a lower rate. Plus, a shorter term will lower the amount of interest you pay over the course of your loan.

Browse through the different loan types we offer and determine which loan is best for you.

Check out the current rates for our mortgage products.

Privacy Notice, Consumer Caution and Home Ownership Counseling Notice, Electronic Correspondence Disclosure and Agreement, Mortgage Information, Nationwide Mortgage Licensing Systems IDs, Home Mortgage Disclosure Act Notice, Consumer Handbook on Adjustable-Rate Mortgage, CFPB Your Home Loan Toolkit

Home loans available for homes in the following states: Michigan, Alabama, Arizona, Colorado, Florida, Georgia, Illinois, Indiana, Kentucky, Minnesota, Missouri, North Carolina, Ohio, Oregon, Pennsylvania, South Carolina, Tennessee, Virginia, Washington, and Wisconsin. Construction home loans are available in Michigan and Illinois. Rates are based on creditworthiness, loan-to-value (LTV), property type, and other factors associated with your loan application, your rate may be higher.

APR is annual percentage rate, and is subject to change. Your rate will depend on your credit score and the term. The loans subject to credit approval.